What we offer for venture funds

Lower costs => more profit

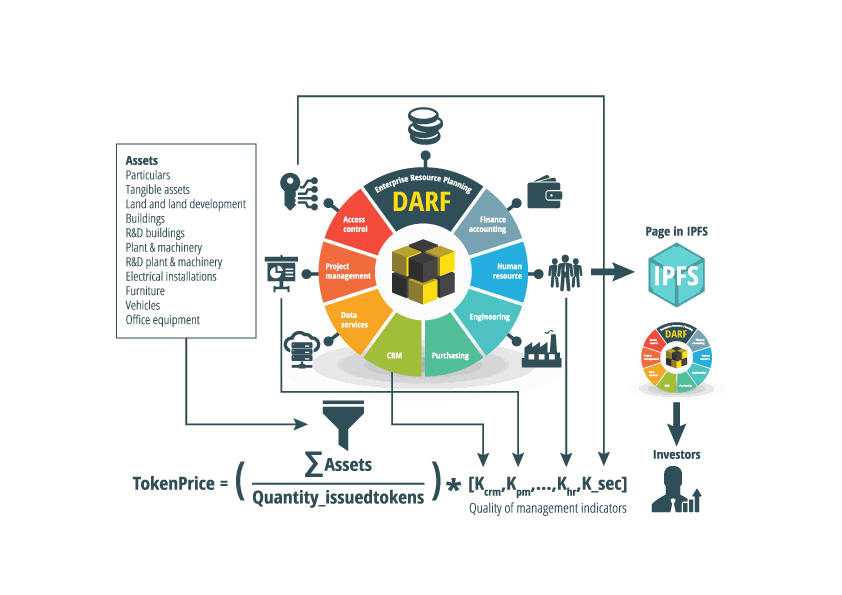

Transparency

Due to the open startup approach, we significantly reduce for funds as second investors the costs of due diligence of projects. Working with us, funds do not bu y “a pig in a poke” with a "painted" pedigree but can see the whole story of the project.

Navigation

In the course of the project, we gravely reduce in projects risks of the wrong market, through the mechanism of the collective wisdom of investors.

Cash flow control

Also, we seriously reduce the cash gap risks, through the mechanism of smart escrow.

Skills pumping

We offer to trainers, coaches to work with project teams to pump their soft and cognitive skills, which can give pivot projects to qualitatively new markets

Crowdinvesting

We attract crowd-investment, that reduces risks of the institutional investors and scale business angels.

Forecasting

With our forecasting mechanisms - we predict the request of global venture players.

Multi-dimensional measuring of velocity

“Open startup” means that team works transparently right from the start to provide investors, community, customers trustful info about their traction: